Dear Dianne,

I’ve been working in my current office for five years. I went to work at an hourly rate that was a little lower than the average for my area with the promise that I would get a “significant” raise 90 days after I was hired. What I got was a $1 per hour raise, and I haven’t had any more raises since that time. So, I recently asked for a raise. The doctor seemed surprised, and then he told me he is working on implementing a bonus system for the office. What are your thoughts on bonus plans? Do you have a particular one you like?

Pam, RDH

Dear Pam,

More than four years without a pay increase is a long time. Yet I can’t imagine that this doctor has not raised his fees in more than four years. I encourage doctors to institute fee increases each January 1, and then give any pay increases they feel are appropriate on April 1.

However, before any bonus plan is implemented, the business owner should evaluate the reason for the bonus plan. If the reason is to prop up a weak pay scale, that’s not a good reason. Doctors with weak pay scales have a difficult time attracting and keeping high-quality staff members. If the reason is to provide motivation and reward staff members when collections and production are stellar, that’s a good reason.

Here is what a properly designed bonus is supposed to do:

• Eliminate staff complaints about occasionally working through lunch or after hours.

• Cause employees to police themselves and work for the common good; slackers are not tolerated by the rest of the group.

• Show gratification for hard work.

• Ensure the schedule stays full.

Bonus incentives can be a motivating force among staff members if:

• the bonus is attainable,

• the bonus is fair,

• the bonus is understandable and simple, and

• the reason for giving the bonus is to allow staff members to share the wealth when the practice is financially healthy since they are such an integral part of the practice success.

There are many different bonus plan formulas. Some are so complicated that staff members have a hard time understanding them.

Here I’ll share a few bonus plans that I like.

Bonus idea No. 1

This is a good bonus plan because it is dependent on collections. You cannot pay out what you do not collect. When the practice has a good month, the staff members are allowed to share in the success.

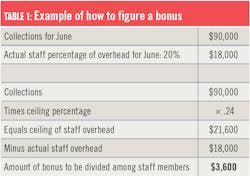

Set a goal for the total amount of staff salary overhead you wish to maintain. For example, let’s say the staff salary percent of overhead is anywhere from 19% to 24% of total overhead during a 12-month period. Set your ceiling at 24%. Let’s say June was a great month with high collections, and staff percentage of overhead is 20%. Take the extra 4% and divide it among the staff. Part-timers get a share commensurate with the amount of time they worked. See Table 1.

Bonus idea No. 2

Gross production is full-fee production. Adjusted production is after write-offs. Adjusted production is the true production— the amount the office expects to collect. Most offices today participate in at least one PPO plan that requires discounting production for those patients who have dental benefits.

So, calculate the average adjusted production for a three-month period by adding the total adjusted production and dividing it by three. This is the average monthly adjusted production. Set the goal a little higher. For example, if the average monthly adjusted production is $80,000, set the goal at $83,000. If the goal is reached, each staff member receives $100. Adjust the goal every three months, either up or down, to keep the bonus attainable. If the goal is raised, increase the bonus by $25.

Keep in mind that one of the problems with monthly bonuses is that not all months are the same length. February is short, July is long, and vacation time must be considered. It seems unfair to base the bonus on a standard month. To address this disparity, determine a number of production days you will work this year (180 is standard) and divide that by 12 (months in a year). The resultant number of days (15 in this case), and that is your cycle. The first 15 production days of the year represent your first cycle. This creates a fair incentive system with equal days.

Bonus idea No. 3

This one is called “random acts of kindness.” If you examine research from the behaviorists, they have found that random reinforcement acts as a stronger motivator than any type of automatic reinforcement program. Animal studies have demonstrated that incentives work better if animals are not sure they will receive a reward after a certain number of correct responses.

Surprise bonuses are a powerful motivator. Bonuses—that are not expected—given by the boss out of appreciation for hard work and a job well done generally have a more positive impact than a formal bonus system. Formal bonus plans can be impersonal and can have the potential for disappointment. A nice touch is for the boss to write a short thank you note to give with the bonus. My preference is that employers pay their staff members well and reward them with surprise bonuses at random times throughout the year.

Final thoughts

One of the largest costs to dental practices is labor costs. The industry standard is to keep staff costs at 24%–28% of total overhead (depending on what is counted). If the practice is financially healthy, there’s no problem taking care of employees. If the practice is struggling, declining, or even failing, it may be very difficult for a doctor to keep overhead in line and compensate employees well.

Bonus plans can have caveats and disadvantages, such as:

• bonuses do not compensate for poor schedule control,

• staff members come to expect the bonus,

• bonus incentives should not be a way to prop up weak base pay,

• some doctors become unhappy when they realize the financial impact of a bonus system, and

• when production and/or collections are part of the bonus formula, scheduling coordinators may delay certain procedures or delay posting payments until the next month if the goal has already been met.

If you do not already, I urge you to learn your current salary to production ratio. Over a three-month period, total your production and gross pay. Divide your pay by the production (big number into the little number) and move the decimal two places to the right. This is your salary to production ratio. The industry standard is 33%. If you find the percentage is more than 33%, look for ways to increase your production. If your percentage is lower than 33%, you have a basis for a pay increase.

All the best,

DIANNE GLASSCOE WATTERSON, MBA, RDH, is a consultant, speaker, and author. She helps good practices become better through practical analysis and teleconsulting. Visit her website at wattersonspeaks.com. For consulting or speaking inquiries, contact Watterson at [email protected] or call (336) 472-3515.